April 19, 2016

Anatomy of a Regulatory Change – Pt.1:

Understanding the regulatory change process

By: Tim Owen

I talk to our customers all the time about the importance and difficulties of effectively and efficiently adapting to regulatory changes. Whether it's a regulator, agency, education provider, securities firm, or carrier customer, the same question often seems to surface:

What's so hard about it?

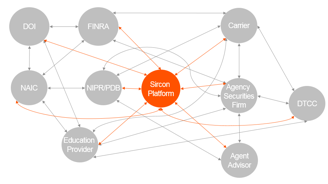

Here's the short answer. A regulatory change generates an extensive web of dependent and inter-connected changes across all the stakeholders involved in getting, keeping, and verifying agents, advisors, adjusters, and other licensed individuals are authorized to sell or service insurance or securities. Karen Horning, Executive Director of the NIPR, calls it the butterfly effect. Even a seemingly small change can have a large ripple effect of changes on the industry. And as you can see, this is a tangled web indeed.

Let's walk through this. State and federal legislative changes and statutes are driven by consumer protection concerns, to become more uniform and reciprocal with other jurisdictions (for example, adopting an NAIC model act), and for security, operational and technical reasons. These policies and changes are enacted often with incomplete understanding of the full impact on and cost to the industry. These impacts and costs may eventually get passed on to consumers or reduce the industry's margins which are already thin. Consequently, the ability to reduce the cost of regulatory changes can impact consumer service and industry financial health in a very positive way.

Once a regulatory change is decided upon, the long sequence of dependent changes are set in motion.

- If the change is legislative or statutory, the regulators (State DOIs and/or FINRA) interpret the change and determine how they will implement and enforce the change.

- Once the regulator decides how to implement the change, it communicates the change and effective dates, grace periods, exemptions, etc. to the industry. How long the industry has to comply, of course, can vary substantially. The shorter the lead time, the more chaotic and costly it is for regulators and industry to implement a change.

- The regulator works with their solution providers or IT and with internal operational functions to update their procedures, regulatory management systems, and integration points with NIPR, NAIC, solution providers (like exam vendors, Vertafore, etc.), and industry. Those changes can be complex process changes, software changes, rule changes, and data changes, and often a combination of all four.

- Industry utilities and standards including the national producer database (PDB), the NIPR gateway, FINRA WebEFT, ACORD standards, DTCC services like their license and appointment (LNA) service may need to be updated and communicated to solution providers and industry.

- Solution providers and the industry, often in parallel with the work the utility providers are doing to implement changes, update their procedures, compliance management systems, integration points (internal, business partner, solution provider, regulator), compliance data, and other downstream operational management systems.

- Then when the change becomes effective, all of these dependent process, software, integration, and data changes also go-live.

Of course, with all these moving parts, there is substantial opportunity for issues to arise that impact business and add delays and costs until they are resolved.

To help smooth this process, organizations like SILA, IRI, ACORD, DTCC, LBTC, IIABA and others work with their members, solution providers, and regulators to create best practices and standards to reduce the cost and make the processes across stakeholders more consistent. Of course, standards and best practices are useful only to the extent they are adopted.

You Must Be Proactive!

The secret to success and getting ahead of the regulatory change curve is to be proactive by closely monitoring potential changes. Unfortunately, this takes a lot of time and effort. To illustrate, in 2015 there was roughly one regulatory change per business day; that's 286 regulatory changes to track, plan, and adapt to in one year.

This means thousands of updates to processes and systems in order to comply!

Communication is Key

Given all the stakeholders involved and the complexity of regulatory compliance, communication across the regulatory-compliance value chain is critical. That is why Vertafore's Sircon solutions team actively works with all the stakeholders and organizations that help create standards and best practices. We are members of SILA, IRI, ACORD, DTCC, and LBTC. We participate in or lead their working groups related to compliance. Since we are an authorized business partner of the NIPR, and we work with 22 state regulators and many securities firms, we also work closely with the NAIC, NIPR and FINRA on regulatory changes, and operational and technology initiatives. And most importantly, we provide solutions to all the key participants in the value chain. We do this intentionally to ensure our solutions are accurate, current, and efficient throughout the value chain.

The Sircon regulatory compliance team, for example, dedicates their time to monitoring regulatory changes and applying best practices to adapt to and comply with those regulatory changes. This team provides a central point for connecting all the dots and coordinating the activity of all the other functional teams involved with delivering our software and service solutions. That team helps clarify and communicate changes internally and externally with our partners and customers.

A Helping Hand

If you are like most organizations, you work with solution providers to help with regulatory operations or compliance. So when you are considering new or assessing your existing solution providers for your business, it is critical to understand how regulatory changes are implemented from start to finish so you can be confident you have a solid solution with the least total cost. Make sure that you or your solution provider has an expert understanding of the entire securities and insurance compliance lifecycle and value chain, and that understanding spans all the stakeholders in the value chain.

This expertise isn't something that can be learned quickly. And often the expertise that is acquired is limited to one or two perspectives in the value chain.

Here are six questions that can help you kick off your conversation with solution providers:

- How do you stay abreast of regulatory changes?

- How do you analyze and implement regulatory changes?

- How do you connect / integrate with all the impacted stakeholders?

- Is your process automated?

- How do you communicate changes with your customers?

- How do you tie insurance and securities compliance requirements together, especially for dually regulated products?

Anatomy of a Regulatory Change: A series

Over the next several weeks we will share some of our secrets, and review the inner-workings of regulatory changes through our Anatomy of a Regulatory Change blog series.

We will break down the process of a regulatory change from beginning to end; and show how you educate yourself and proactively monitor and best practices to adapt to change, as well as discuss potential issues that could happen along the way.

Stay tuned for our next post from an industry expert to begin your journey through a regulatory change, focusing on what prompts a change, how a change is carried out, and helpful resources to proactively monitor change.

Industry veteran Tim Owen brings nearly 20 years of expertise in creating and deploying usable and scalable technology solutions for the insurance and securities industries. As Vice President of Product Management, Tim focuses his attention on delivering high-level strategies for product development, product requirements, product launches, and regulatory compliance for Vertafore's Producer Lifecycle Management offerings.