July 30, 2018

Staying Ahead of Regulatory Change

By: Jennifer Middlin

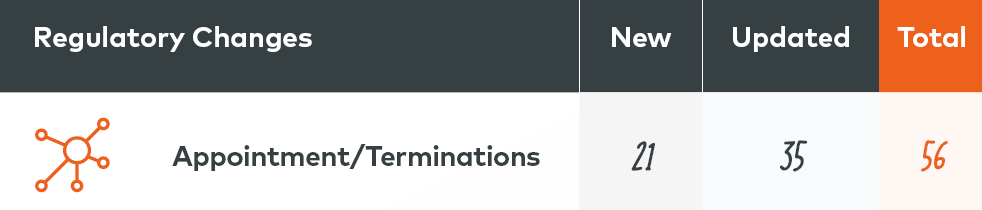

The insurance industry has no shortage of compliance rules and regulations to keep track of. With 54 regulatory bodies and hundreds of different carriers, each with their own appointment rules, compliance quickly becomes a complicated web of information. Not to mention, the changes! In 2017 alone, there were 365 updates to compliance regulations — 56 of which that were related to appointments / terminations.

And you're expected to understand and track all of it.

But if you're a licensing whiz? It's still critical for you to understand compliance: it's a vital aspect of your business from hiring new agents, keeping existing agents compliant, and gaining a competitive advantage.

Who is involved?

In the insurance industry, there are several parties involved that can impact compliance: legislators, trade groups, department of insurance staff, and the NAIC/NIPR, to name a few. By paying attention to these groups and their activity, you will stay informed on what's to come.

Various industry groups have goals that are driven by their members' particular needs and interests. The role of the NAIC and its Producer Licensing Working Group (PLWG), for example, includes developing national uniform standards for insurance licensing for producers, adjusters, and other licensees.

What do the states have to do?

When new uniform standards are developed, states generally have to modify their existing laws to align more closely with those standards. Because each state legislature passes the changes according to their own process, the implementation is not always completely uniform.

Once a regulatory change is decided upon, the long sequence of dependent changes are set in motion. Sometimes these changes touch every producer that sells in a state — think of projects like the Producer Licensing Model Act (PLMA) conversion in the 2000's, which converted "Agent" and "Broker" licenses into "Producer" licenses. As a side note: some states still haven't fully adopted those model law changes from more than 15 years ago! That's how complicated and cumbersome it can be!.

Ans what about your part?

Many changes are easy enough for a human to interpret, on a small scale. For example, a state may separate their "Property & Casualty" appointment line of authority into separate "Property" and "Casualty" appointment lines of authority. Sounds simple enough, but look at it from a data and systems perspective. What was previously a single appointment type is now two appointment types. Any system rules that depended on the previous definition will require attention. Additionally, your records for every producer who was appointed with the old line of authority is now out of date. It's no wonder that such a simple change can lead to compliance issues down the road.

The solution, in many cases, is for carriers and agencies to utilize credentialing and compliance technology to keep track of producer information. This ensures accuracy and helps with the business of authorizing producers to sell insurance products.

So, even if you are that licensing wiz, if you're not using automation to manage compliance, your organization is missing opportunities to increase efficiencies, reduce risk, and improve the agent experience.

Read our infographic, A 5-Step Journey to a Smarter Producer Lifecycle Management to learn more about improving your producer management initiative and see how you stack up to your peers.

Jennifer Middlin is a Product Marketing Manager at Vertafore, where she works on Vertafore solutions for carriers and MGAs. She is an avid reader and news junkie outside of work, but enjoys free time with her kids the most.